[This blog is part of a larger series, to find more parts in the series please see the Series Index]

[This blog is part of a larger series, to find more parts in the series please see the Series Index]

Yesterday’s post covered some interesting, yet very simple features in Microsoft.VisualBasic so today I thought I would cover some more complex code: Financial.

This is a class with 13 static method who all return a Double, and if financial code wasn’t complex to begin with the method names are as cryptic as you can get. I’ve broken them into three groups: cash flow, general, depreciation and annuity based.

Cash Flow

These calculations look at investments and cash flows:

- IRR: Provides the internal rate of return for a series of periodic cash flows.

- MIRR: Provides the modified internal rate of return for a series of periodic cash flows.

- NPV: Provides the net present value of an investment.

Example of using the above methods:

// need to place to store profit/loss

// must have atleast one negative and one postive value in it

IList<double> values = new List<double>();

values.Add(-100000); // startup costs - cost money to make money

values.Add(10000); // income in first year

values.Add(15000); // income in second year

values.Add(17500); // income in third year

values.Add(75000); // income in forth year - got govt. contract that year ;)

double[] valuesArray = values.ToArray();

double loanRateGuess = 0.1; // start guessing loan at 10%

double rateIRR = Financial.IRR(ref valuesArray, loanRateGuess) * 100;

double reinvestmentRate = 0.12; // MIRR also includes the reinvestment rate 12%

double rateMIRR = Financial.MIRR(ref valuesArray, loanRateGuess, reinvestmentRate) * 100;

// working out net present value needs a fixed rate

double fixedRate = 0.08; // 8%

double netPresentValue = Financial.NPV(fixedRate, ref valuesArray);

Console.WriteLine("Net present value: {0:0.00}", netPresentValue);

Console.WriteLine("Rate of return is:");

Console.WriteLine("\t{0:0.00}% (Calculated using IRR)", rateIRR);

Console.WriteLine("\t{0:0.00}% (Calculated using MIRR)", rateMIRR);

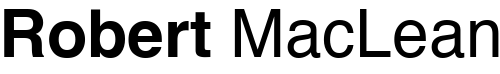

Gives us:

Depreciation

I understand depreciation as: how much value an item loses over time.

- DDB: Allows you to work out depreciation using the double-declining balance method (DDB) or a custom method. The DDB calculation per period is: Depreciation / Period = ((Cost – Salvage) * Factor) / Life

- SLN: Provides a value specifying the straight-line depreciation of an asset for a single period. SLN is calculated using:(Cost - Salvage) / Life

- SYD: Provides a value specifying the sum-of-years digits depreciation of an asset for a specified period. This is similar to DDB but calculated differently.

Example of using all the above methods to figure out how much you lose on an iPhone over two years:

double iPhoneInitialCost = 10000;

double iPhoneResale = 3500;

double YearsUntilNextUpdate = 2;

// work out deprecation per year

double deprectionPerYear = Financial.SLN(iPhoneInitialCost, iPhoneResale, YearsUntilNextUpdate);

double sydValue = iPhoneInitialCost;

double ddbValue = iPhoneInitialCost;

for (int year = 1; year < YearsUntilNextUpdate + 1; year++)

{

double syd = Financial.SYD(iPhoneInitialCost, iPhoneResale, YearsUntilNextUpdate, year);

double ddb = Financial.DDB(iPhoneInitialCost, iPhoneResale, YearsUntilNextUpdate, year);

sydValue -= syd;

ddbValue -= ddb;

Console.WriteLine("In year {0} you will lose", year);

Console.WriteLine("\t {0:0.00} (Calculated using SYD)", syd);

Console.WriteLine("\t {0:0.00} (Calculated using DDB)", ddb);

Console.WriteLine("Phone value");

Console.WriteLine("\t {0:0.00} (Calculated using SYD)", sydValue);

Console.WriteLine("\t {0:0.00} (Calculated using DDB)", ddbValue);

Console.WriteLine();

}

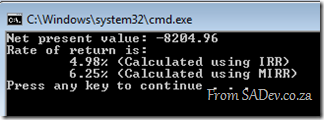

Which gives us the painful realisation of how quick value is lost:

Annuity Based

An annuity is a series of fixed cash payments made over time. An annuity can be a loan (such as a home mortgage) or an investment (such as a monthly savings plan).

If you are working out annuities there is a number of calculations around those:

- If you have the payment, period and interest you can work out the future value using FV over a period.

- If you have the future value, payment and period you can work out the interest using IPmt over a period.

- If you have the future value, payment, and interest you can work out the period using NPer over a period.

- If you have the future value, period and interest you can work out the payment using Pmtt over a period.

Other methods around annuities:

- PPmt: Calculate the principal payment of an annuity.

- PV: Calculate the present value of an annuity.

- Rate: the interest rate per period for an annuity calculated by iteration.

Example of using FV to work out savings:

double monthlySavings = 1000;

double interestRate = 8;

double yearsYouWillSave = 10;

double deposit = 0;

// specifies if you save at start or end of month

DueDate dueDate = DueDate.EndOfPeriod;

if (interestRate > 1)

{

// must be expressed as a percentage

interestRate = interestRate / 100;

}

// converted to interested per month

interestRate = interestRate / 12;

// figure out how many months that is

double months = yearsYouWillSave * 12;

// note savings and deposit are converted to negative as we are saving

// if we were paying off they would be positives

double savings = Financial.FV(interestRate, months, -monthlySavings, -deposit, dueDate);

Console.WriteLine("In {0} years, you will have saved: {1:0.00}", yearsYouWillSave, savings);

gives us: